The Numbers Game: Budgeting Strategies for the Financially Disinclined

You can keep track of expenses — and live well — without spending hours agonizing over every cent spent.

Most people would rather pass a kidney stone than learn about personal finance, much less put their financial house in order.

Yet choosing a basic fiscal tracking system can enhance your peace of mind, quality of life and retirement plans.

With the understanding

that people have varying

levels of financial

literacy — and limited time

to balance their income-

to-expense ratio — I’ve

searched for general strategies that veterinarians can implement with relative ease. I’ve found three concepts to be particularly powerful despite their apparent simplicity.

The 50-30-20 Solution

This system is based on the notion of separating your after-tax income into three broad categories: needs (50 percent), wants (30 percent) and savings (20 percent).

Your needs include everything required to live, such as food and shelter (housing and utilities), plus transportation,

insurance (health, disability, life, home,

car), child care and other necessities. Notice that cellphone and internet expenses are absent from this group. These are considered wants because, believe it or not, you can survive without them.

RELATED:

- 7 Personal Finance Tips for Veterinarians

- Banishing Budget Obstacles

Wants improve your overall quality of life but are not essential, such as a gym membership, a cellphone plan, entertainment, vacations, gifts and beauty products. These are considered luxuries.

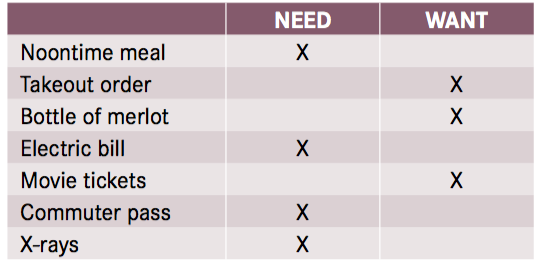

A primitive way to decipher between needs and wants is to determine whether you can delay spending money on something without severe consequences, such as going to jail, losing your property or paying a fine. If you cannot delay the expense (alimony, credit card bill, car payment), then the item is a need. However, if you can put off the purchase (designer clothes, vacation, cellphone upgrade), then the product or service is a want.

The final category, savings, represents the remaining 20 percent of your net income. You could split this amount into two equal portions, setting aside 10 percent for short-term savings or an emergency fund and 10 percent for retirement investing.

The 70-30 Rule

The system was inspired by author and motivational speaker Jim Rohn, who recommends living on 70 percent of your income and setting aside

30 percent. The 70 percent portion includes every- thing you need or want — food and clothing, small pleasures and even luxuries.

What about the remaining 30%? Rohn advises an even three-way split: giving, investing and saving.

The 60 Percent Solution

The 60 percent solution is a little more complex because it involves more specific categories. That complexity also makes it one of the best systems available for managing your money.

Financial expert Richard Jenkins, the creator of this concept, advises allocating 60 percent of your net income to “committed expenses” — grocery bills, clothing, insurance plans, debt repayment, charitable giving and recurring charges. Divide the remaining 40 percent equally among four categories:

- Short-term savings: earmarked for nonessential expenses that may or will predictably occur in the near future, such as birthday presents, vacations, repairs and maintenance

- Long-term savings: needed in the future for education, a special vacation or a down payment on a large purchase, such as a house

- Retirement savings: allocated to employer- directed plans and other investments

- Fun money: used for entertainment, bungee jumping, long weekends, etc.

Of course, you can fund these unequally, but if you do that, chances are you will spend more on entertainment and less on retirement. That might sound like fun at the moment, but it will hurt your ability to retire comfortably.

Implementing the Concepts

These three concepts provide multiple options based on your current spending habits and goals. Plus, you don’t have to monitor everything you spend every day, although it is a good idea to reevaluate your spending on a regular basis to assess whether it matches the percentage breakdowns from the system you chose.

If the percentages are radically different, then you’ve just proved to yourself that your lifestyle doesn’t match your paycheck, and you need to make adjustments.

Ultimately, what matters is that you don’t splurge to a degree that leaves you unable to remain current on meeting your necessary expenses, as well as saving and investing for

the future. Living in the moment is a wonderful concept, but so is planning. It is possible to keep your expenses in check without worrying about overspending in a particular category. The nice thing about all these systems is that they provide opportunities for added pleasures, experiences and much-earned vacations.

Dr. Zeltzman is a board-certi ed veterinary surgeon and serial entrepreneur. His traveling surgery practice takes him all over eastern Pennsylvania and western New Jersey. You can visit his website at DrPhilZeltzman.com and follow him at facebook.com/DrZeltzman.